Candlestick patterns never mislead us in wrong trading directions. So here’s the deal, making us well equipped with the proficiency in few key candlestick patterns would improve the ability to time the market, recognize the trading opportunities and enter at better levels.

We come up with some live instances where such leading indicators were figured out and observe their desired results.

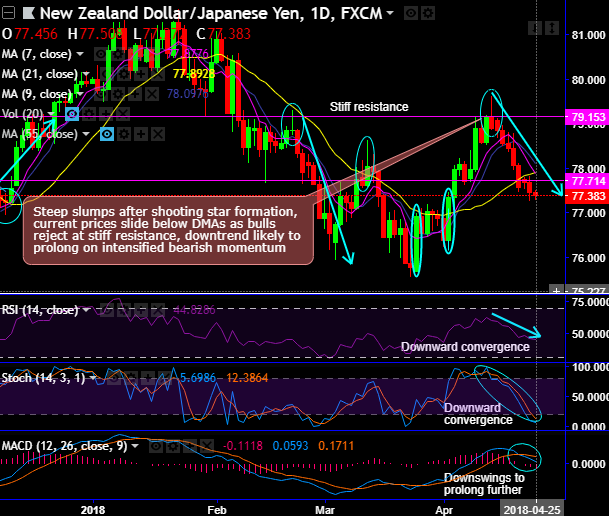

NZDJPY’s bullish engulfing: Sharp rallies above DMAs were observed especially after bullish engulfing pattern on this pair as well (refer daily plotting). This is deemed as a reversal pattern that could either be bearish or bullish subject to whether it occurs at the end of an uptrend (bearish engulfing pattern) or a downtrend (bullish engulfing pattern). The first day is characterized by a small body (refer the previous candle of circular area at the bottom of daily chart), followed by a day whose body completely engulfs the previous day's body and closes in the opposite direction of the trend.

But for now, contrary to the above pattern failure swings at the stiff resistance have formed the sharp-shooting star pattern, you could make out steep slumps since then. While both leading indicators signal intensified bearish momentum.

NZDUSD’s: As you could refer daily plotting of NZDUSD, upon doji and shooting star patterns, the bears resume again in the minor trend especially after the failure swings at the channel resistance and tumbled towards channel supports. More details on the same are available in the below weblink:

USDJPY’s bullish engulfing: We spotted out USDJPY’s bullish engulfing candlestick patterns at 105.396, 106.842 and 106.600 levels in the recent past. Ever since then, the stern rallies have taken the current prices well above DMAs. The call has been advised on the bullish pattern candlesticks when USDJPY spot FX was trading at 106.950 levels, for more reading on the same, refer the below weblink posted on 12th April:

Well, you’ve seen the bullish effects of this pair as the USD staged a strong recovery in the second half of last week, which has taken prices back to important resistance levels within the medium-term range. This comes as US equities have slipped back to the middle of their current trading range (a plethora of key tech stock Q1 earnings reports are due this week) and US yields have extended recent gains, with 10-year yields now close to the psychological 3% level.

FxWirePro launches Absolute Return Managed Program. For more details, visit: