Chinese auto manufacturers got a big boost after government on September 30th slashed the purchase tax on small cars by half to 5% for passenger vehicles with engines that are 1.6 liters or smaller. The move can benefit both buyers and automakers. As a result, in two trading days, auto stocks listed on Shanghai Stock Exchange went limit up 10% - 30%. What does China's sales tax cut mean for the economy?

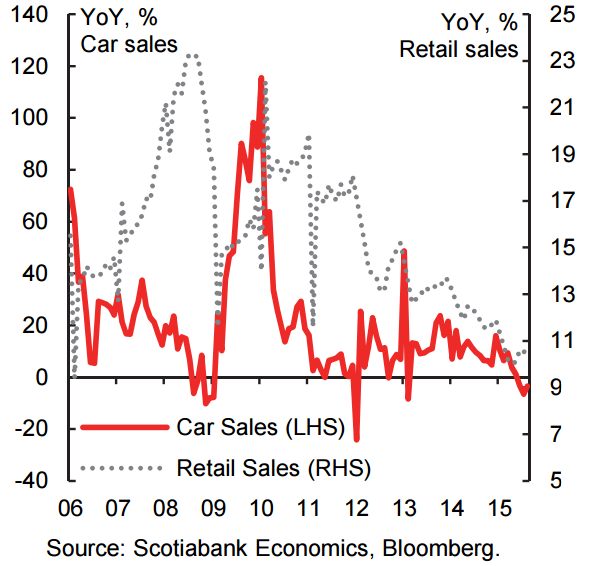

Beijing has done this before, in 2009, when it implemented a similar tax cut, bringing sales growth from negative territory in the fourth-quarter of 2008 to over 50% growth rate in 2009. Can the same trick work again? The move may seem minor, but it has important economic and policy implications worth recognizing in the broader China context.

While it's true that most economic activity indicators have softened this year, car sales have been particularly weak in recent months, substantially underperforming overall retail sales growth of +10.8% y/y. The rate cuts announced by PBoC have not had much impact on the country's sagging economic growth. However, a purchase tax cut could have some impact, as it directly benefits consumers.

"We estimate that auto sales and production account for more than 10% of the economy. More than 70% of all passenger vehicles sold in China have engine capacity of less than 1.6 liters, so the tax cut is well targeted to hit the majority of the sector", said Scotiabank in a research note.

Lower vehicle prices could benefit China's faltering car sales. From a demand-side perspective, there is plenty of capacity for the industry to grow domestically. Many fence sitters tend to move up their planned purchases to take advantage of such measures. Moody's expects the tax cut to be attractive to price-sensitive buyers and said that the limited duration of the tax cut will entice buyers to move up their purchases.

"While the impact will likely be more subdued in this slower growth environment, we expect the tax cut to help support the purchase of at least an additional one million vehicles", added Scotiabank.

The tax cut may initially appear to be a narrow fiscal target, but the move is intended to stimulate broader economic growth. It emphasizes policymakers' ongoing focus on the auto sector as a key driver of growth and employment in the Chinese economy. Moreover, the expiry date on the stimulus, valid only until December 2016, is clearly intended to create an immediate jumpstart to growth.

"GDP growth might not pick up as rapidly as it did in 2009, and the passenger vehicle penetration rate is much higher now than in 2009. Therefore, we believe the positive impact should be less significant this time. We increase our 2015e/16e PV sales volume growth forecasts to 2.0%/6.3%YoY from 0.5%/4.1%," forecasts HSBC Economics in a report.

USD/CNY is trading at 6.3328 as of 1014 GMT. Hang Seng index closed up 1.2 pct at 22,730.93 point, Shanghai composite index up 3.3 pct at 3,287.66 points with volumes highest since sept 2.

Can China's auto sales tax cut have a significant impact on GDP growth?

Monday, October 12, 2015 11:16 AM UTC

Editor's Picks

- Market Data

Most Popular

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight