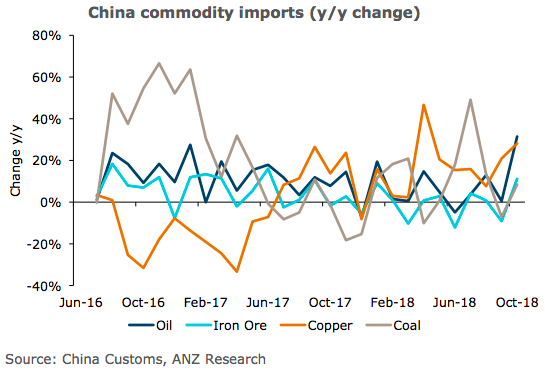

China’s appetite for imported commodities remained strong in October. While most commodities recorded m/m falls, growth remained high on a y/y basis. Copper and crude oil demand was particularly strong, while iron ore and coal recorded solid growth.

"We suspect a combination of robust underlying demand (including a rebound in infrastructure spending) and supply-side reform measures will continue to drive strong volumes," ANZ Research commented in its latest report.

Crude oil imports rose 9.6 percent from September to 40.8mt (~9.97mb/d) in October, as uncertainty around tariffs on US imports and sanctions on Iran eased. Growth was even more impressive on a seasonal basis, at 31.5 percent y/y.

The imposition of tariffs on US imports had little impact on its insatiable appetite for natural gas. Imports rose 25.7 percent y/y to 7.3mt. Imports of copper continued to rebound after a soft patch mid-year. Total volumes reached 423kt, down from September but 28.2 percent, higher than October 17. This backs-up other data – such as falling inventories (included bonded warehouses) and rising premiums – which suggest fundamentals are strong.

Tight scrap markets would also have contributed to this strength. Iron ore imports were marginally down from September but rose 11.2 percent y/y to 88.4mt in October. There is likely to have been so restocking, prior to planned curbs on steel production over the upcoming winter, the report added.

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January