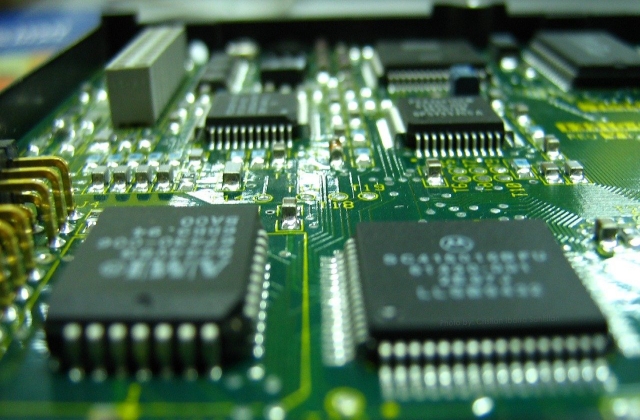

China has criticized the U.S. for intensifying restrictions on its semiconductor industry, warning that such actions will ultimately backfire. The Chinese foreign ministry accused Washington of pressuring other nations to target China’s chip sector, which it says will disrupt global semiconductor development.

Foreign ministry spokesperson Lin Jian stated during a regular press briefing on Tuesday that the U.S. strategy to curb China’s semiconductor progress would not only hinder technological growth but also create instability in the global supply chain. He emphasized that such coercion goes against fair competition and free trade principles.

The Biden administration has been tightening chip restrictions on China, aiming to limit its access to advanced semiconductor technology. The latest move includes potential new rules that could further restrict U.S. companies from supplying critical chipmaking equipment to Chinese firms. Washington argues these measures are necessary for national security, but Beijing sees them as an attempt to suppress its technological rise.

China has consistently opposed U.S. efforts to block its chip advancements, warning that these restrictions will harm American businesses and global industry players. The ongoing tech war between the two nations has intensified as the U.S. continues to rally allies in its push against China’s semiconductor ambitions.

As competition in the semiconductor industry escalates, global markets remain on edge, with potential repercussions for supply chains and innovation. Experts warn that restricting China’s chip access could disrupt production worldwide, affecting industries reliant on semiconductors, from consumer electronics to artificial intelligence.

While the U.S. seeks to maintain its technological edge, China remains firm in its stance, vowing to push forward with independent innovation despite mounting challenges.

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine