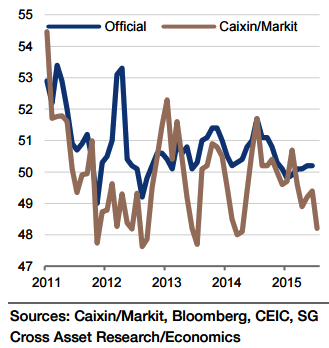

Both Chinese production and new orders headed south. Prices and inventory measures deteriorated. The Caixin China flash manufacturing PMI unexpectedly dropped from 49.4 in June to 48.2 in July, the lowest reading in 15 months.

This report suggests domestic and external demand probably weakened again in July. It is also reported that automobile manufacturers are taking an unusually long summer break, as a result of soft sales and high inventories.

That said, the official PMI covers more large enterprises whereas the Caixin PMI surveys more small- and medium-size enterprises (SMEs). And the June official PMI report shows that large enterprises performed better than SMEs.

"The official PMI is expected to decline only slightly to 50.1 in July from 50.2 in June", forecasts Societe Generale.

China official PMI likely to tick down in July

Friday, July 31, 2015 5:53 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX