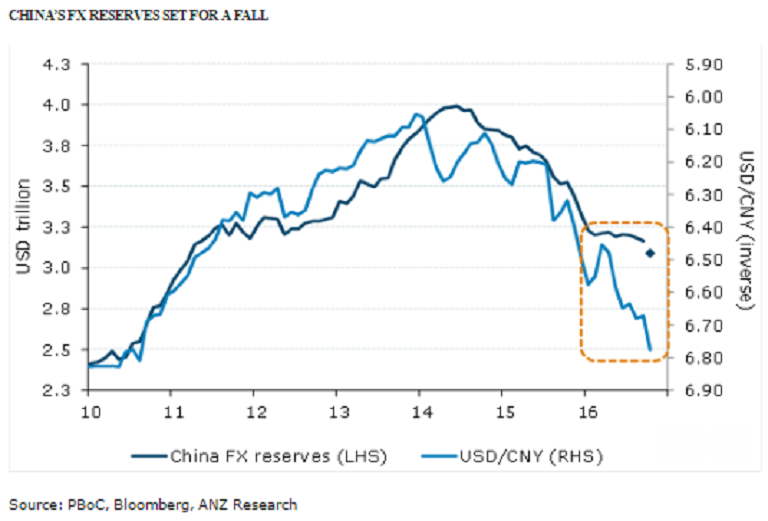

The foreign exchange reserves of China are expected to have sharply fallen during the month of October, following rising intervention from the People’s Bank of China (PBoC) amid strong appreciation of the greenback against its major trading partners and capital loss on fixed income investments.

China’s FX reserves data for October is due for release on 7 November. Despite the weakening in the yuan against the dollar since April, China’s FX reserves have remained fairly stable, with only modest declines recorded in August and September. A further resumption of dollar strength, coupled with the upcoming U.S. presidential election will add to the decline in FX reserves in the world’s second-largest economy.

The PBoC has increased their intervention activity in the past few months, as the market’s demand for dollars increased. It is estimated that during periods when the CNY is under weakening pressure, the PBoC’s FX activity as a share of the total spot trading volumes will rise to around 10 percent or more.

The USD was strong in October, appreciating against most other major currencies. This means that FX valuation effects will be negative in the month. Assuming their allocation is similar to the global aggregate based on the IMF’s COFER data, it is estimated that currency valuation effects will reduce their reserves by around USD30 billion, ANZ reported.

During October, fixed income markets sold off across the board, so mark-to-market losses on their portfolio will reduce the value of China’s FX reserves. Looking at just China’s US Treasury holdings alone, the report estimates that mark-to-market losses would be around USD15 billion.

"For October, we see all key elements acting to reduce China’s headline FX reserves by the most since January, and certainly a lot more than the USD19.1bn decline that the market is anticipating," ANZ commented in its latest research report.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock