China's housing investment should start to see a slightly more pronounced recovery after four months of sales rebounds. Nominal retail sales might have improved as well given a higher inflation rate.

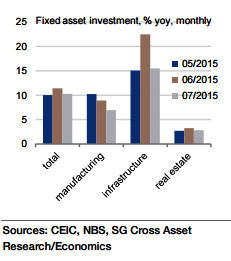

"China's activity growth is expected to have recovered in August. Industrial production growth is expected to tick up to 6.6% yoy from 6.0% yoy, mostly thanks to a weaker base. Fixed asset investment likely grew 13% yoy in August, vs 10.3% yoy in July", says Societe Generale.

This would lift the yearto-date growth to 11.4% yoy from 11.2% yoy. Again, positive base effects probably explain part of the acceleration, while infrastructure investment growth should have received solid support from bank credit and government measures.

China's activity growth likely to improve

Monday, September 7, 2015 6:16 AM UTC

Editor's Picks

- Market Data

Most Popular

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security

China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security  China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength

China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength  Oil Tanker Attacks in Gulf Escalate U.S.–Iran Conflict, Driving Energy Prices Higher

Oil Tanker Attacks in Gulf Escalate U.S.–Iran Conflict, Driving Energy Prices Higher  Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks

Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks  Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume

Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty