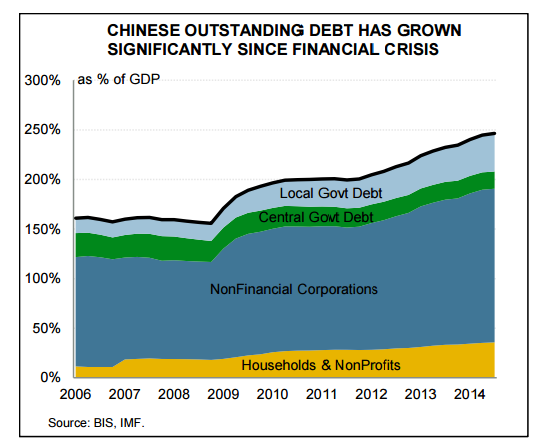

As swift as economic growth has been in China, credit growth over the last several years has been even more rapid. Following the financial crisis in 2008-09 and again as growth flagged in 2011 and 2012, China undertook large-scale credit-fuelled stimulus in order to boost its economy. This led to a surge in non-financial sector debt, which has grown from 156% of GDP in 2008 to roughly 250% of GDP at the end of 2014 - levels surpassing that in some advanced economies. On a sectoral basis, the biggest growth in debt has been within the non-financial corporate sector2 , where over-investment in many sectors has led to overcapacity.

This can only go on so long. The resulting debt overhang is already putting serious strains on the economy. Non-financial private sector debt was equal to 193% of GDP as of the fourth quarter of 2014. Simplistically assuming a seven-year rolling average of the weighted lending rate, the sector is currently spending roughly 12.1% of GDP on annual interest expenses alone. This is over 50% more than it was paying in early 2009. Lowering this debt burden would require deleveraging and/or lower interest rates. For this reason alone, further interest rate cuts from the People's Bank of China (PBoC) appear likely.

China’s debt overhang is weighing on its economy

Thursday, July 23, 2015 10:17 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX