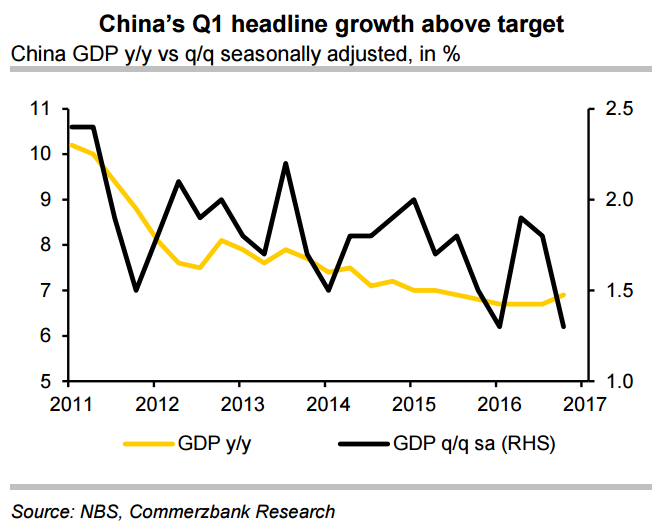

According to data published by the National Bureau of Statistics (NBS) on Monday, China’s Q1 2017 GDP grew by 6.9 percent y/y, beating forecasts for a 6.8 percent rise. On an annualized basis, China’s growth slowed it pace of expansion, coming in at 19 percent versus 1.7 percent last. Data showed China's policymakers leaned on infrastructure and real estate investment to drive expansion in the first quarter.

Credit surge likely fueled stronger investment and industrial activity. Despite efforts by authorities to crack down on debt risks, China's total social financing, a broad measure of credit and liquidity in the economy, reached a record 6.93 trillion yuan ($1 trillion) in the first quarter. Government spending rose 21 percent from a year earlier. Higher government infrastructure spending and persistent property boom helped boost industrial output by the most in over two years. Industrial production also rose to 6.8 percent y/y in Q1 2017, up from a 6.0 percent growth for 2016.

"The Chinese government has a tendency to rely on infrastructure development to sustain growth in the long term. The question we need to ask is whether this investment-led model is sustainable as the authorities have trouble taming credit. We need to watch closely whether China’s top leadership will send a stronger signal to tighten monetary policy shortly," economists at ANZ said in a note.

It is unlikely that the investment will remain elevated for long. As property prices have shown signs of overheating, tightening measures from the People's Bank of China (PBoC) will probably intensify in the coming quarters. As banks’ credit extension will likely slow down in the second half of this year, it follows that investment growth will have to moderate as a result.

"We think that the investment will unlikely remain elevated for long as property prices have peaked and credit growth is expected to slow down in the second half of this year. We believe that the overall growth trajectory will moderate over the next few quarters; therefore maintain our growth forecast at 6.5% for 2017. Meanwhile, CNY will continue to weaken, and USD-CNY is expected to reach 7.10 by the end of this year," said Commerzbank in a report.

Chinese yuan was trading almost flat despite robust industrial production and GDP data. USD/CNY made intraday high at 6.8840 and low at 6.8801 levels. PBOC sets Yuan mid-point at 6.8785/dollar vs last close 6.8855. FxWirePro's Hourly USD Spot Index was at -121.163 (Bearish), while Hourly CNY Spot Index was at 81.9024 (Bullish) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination