While Chinese authorities throws everything to shore up country's falling stock market, business are finding little to cheer about as economic pain continue to persist.

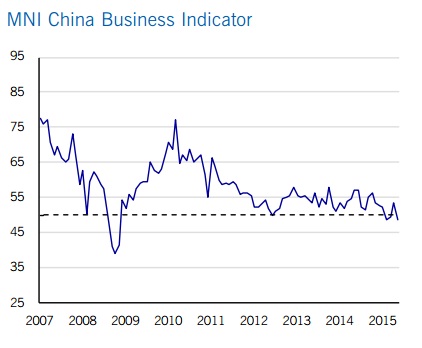

- MNI China Business Indicator fell 8.8 per cent to 48.8 in July, below the 50 mark which indicates optimism. The reading is the lowest since January 2009. However same reading was in April, this year.

Survey consists of responses from 200 companies listed on the Shanghai and Shenzhen stock exchanges.

Though recent drop in sentiment might partially be the result of falling stock market, however some other factors are at play here.

As of recent, some of China's economic indicators such as industrial production, foreign direct investment, house prices have started showing signs of recovery but they remain far away from sustenance as of now.

China while still able to make positive trade surplus, money is flowing at record pace from capital account, putting down ward pressure in country's massive forex reserve, which as of June stands at $3.69 trillion, down 7.5% from a year ago.

Business sentiment indicates that Chinese domestic economy as well as foreign demand is likely to remain subdued over the coming months, though sentiment might improve if stocks rise.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?