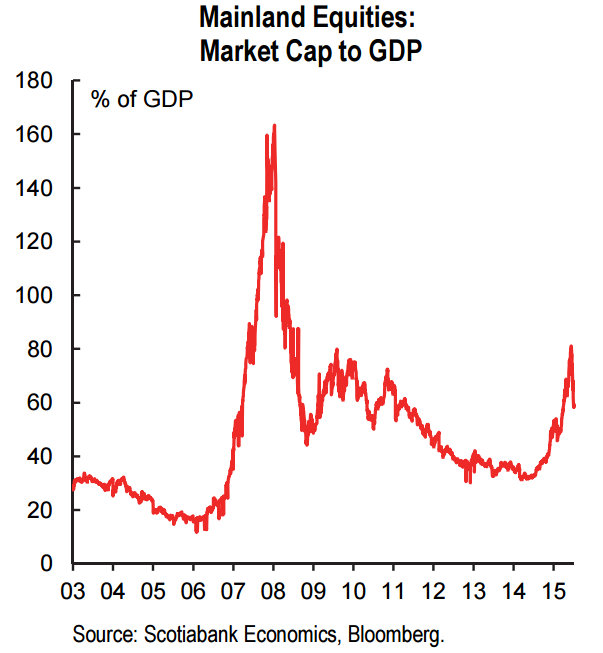

Volatility in the Chinese markets could be far from over. China's Mainland equities fell over 32% after peaking on June 12 despite a myriad of measures implemented by policymakers to halt the correction.

The sharp fall in Chinese equities has started to send shock waves through broader markets. There is a growing fear that the Chinese stock market correction will produce serious knock-on effects that hamper broader growth. The largest direct negative effect of a pronounced stock market decline will be a slowdown in IPO activity. However, Scotiabank opines that equity issuance remains only a small part of financing in China worth about 5% of aggregate financing, and doubts corporate finance will be meaningfully derailed.

"The equity market correction will have only modestly negative and short-lived effects on the real economy, and so does not represent hard landing material", says Scotiabank in a report.

Financial intermediation remains a small share of the economy at about a 6 percentage point weight in Chinese GDP, and there is a little evidence of meaningful linkages between GDP in the financial intermediation sector and volume measures of stock market activity.

"We are not unconcerned about the macroeconomic effects of correcting Chinese equity markets but not sufficiently worried to view it as hard landing material versus a relatively minor and short-lived drag on economic growth and financial stability", adds Scotiabank.

China's foreign trade improved in June with exports rising for the first time since March and the contraction in imports narrowing. Both results were above market expectations. Imports of major commodities rebounded following a weak May. The volume crude oil imports were 7.2mb/d in June, up 26.7% y/y.

"We expect better export and import growth in Q3, but from low levels. External demand should improve, as suggested by better US and euro area data. More importantly, we believe domestic economic activity is finding a floor in Q3, and the negative price effect on imports, in place since H2 14, should start to fade, supporting a smaller contraction in imports. Overall, we expect a current account surplus of 2.9% of GDP for the full year, up from 2.1% of GDP in 2014" estimates Barclays Capital in a report today.

Commodity currencies will be most vulnerable should the Chinese equities rout extend. China's stock market and related policy developments will be more closely monitored by markets.

Chinese equity market correction to have only modest negative macroeconomic effects

Monday, July 13, 2015 10:54 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate