Chinese stock market is the most volatile in the world, though in recent days daily as well as intra-day volatility has come down a lot.

- Few days back, 5 day average of realized volatility reached more than 7%, however several measures and government intervention has pushed it lower, which still stands at quite high of 3.1%.

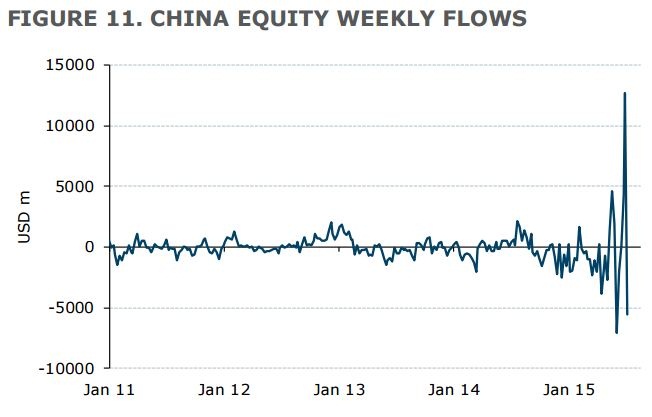

While stock volatility has come down significantly, fund flow volatility has gone up.

- As per latest data from EPFR, Chinese equities saw fund inflow of $12.7 billion for week ending 8th July, just prior to the stock market giving a 15% rally. However next week saw almost $5.6 billion outflow for the week ending July 15th. This makes it second largest outflow since financial crisis.

- In last one month, flows in and out of Chinese equity funds have been -2% to +4% of AUM (asset under management) compared to normal range of +1% to -1%.

Though the data doesn't indicate who is buying or who is selling.

However, it seems it is plausible that inflow has been government directed, whereas outflow due to public taking out money due to panic.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate