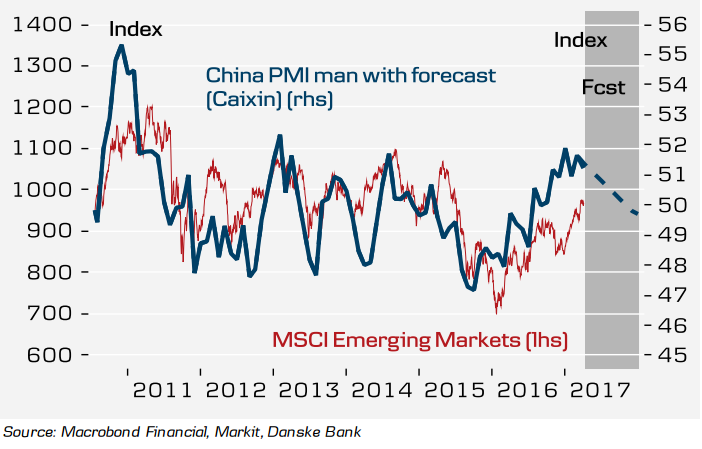

A range of leading indicators for China are sending a clear negative signal for economic growth in H2 2017. Chinese authorities have embarked on tightening and policy boost is likely to fade. The impact from tightening will start to feed through soon. A loss of upward momentum is generally associated with a sign of a peak in the cycle and thus points to slowing growth ahead.

Chinese official PMI manufacturing report showed that the economy remained strong in March. Chinese official PMI manufacturing surprised on the upside, rising to 51.8 (consensus 51.7, previous 51.6). However, analysts feel the improving indicators are the consequence of another enormous splurge of credit. Strength of the housing market at the start of 2017 is likely to have postponed a slowdown.

Chinese growth continued to be strong throughout Q1, but leading indicators point to a slowdown in 2017, said Danske Bank. Over the course of the last twelve months, trade figures deteriorated month after month almost. The IMF has relentlessly extended warnings on debt levels and still monumental overcapacity across the entire economy. The government faces a challenging effort of prioritizing growth over balanced development. As PBOC embarks on further tightening, and investment plans are lower than in 2016, a slowdown looks imminent.

Chinese authorities are likely to concentrate more on de-leveraging and bearing down on overcapacity in the old industrial sectors as consumer demand lifts and new, higher value-chain economic activity expands. The People’s Bank of China (PBoC) is likely to continue on further tightening measures to cool the housing market.

"We continue to look for a peak in Q1 and a moderate slowdown during 2017. As a result China will contribute to a peak in the global business cycle in H1 and provide less support to Emerging Markets and commodity markets. The underlying downward pressure on CNY persists," said Danske Bank in a report.

USD/CNY was trading largely unchanged at 6.8831. FxWirePro's Hourly USD Spot Index was at 106.297 (Bullish), while Hourly CNY Spot Index was at -110.786 (Bearish) at 1140 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election