The Chinese sovereign bonds rallied Tuesday as investors poured into safe-haven instruments amid rising concerns that the country may witness subdued GDP growth with the country unwilling to raise more debt to boost its economy.

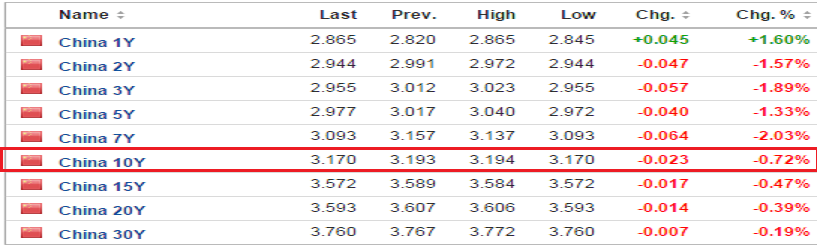

The yield on the benchmark 10-year bonds, which moves inversely to its price, fell more than 2 basis points to 3.17 percent, the long-term 30-year bond yield dipped 3 basis points to 3.76 percent and the yield on the short-term 2-year bonds slid nearly 5 basis points to 2.94 percent.

According to Bloomberg’s report, China’s President Xi Jinping told a meeting of the Communist Party’s financial and economic leading group on Friday that the country may forego its 6.5 percent economic growth objective due to concerns about rising debt and an uncertain outlook for Asia’s largest economy.

Some meeting participants sounded the alarm about unsustainable debt, noting that other nations have experienced crises after borrowing climbed to around 300 percent of GDP, the person said. China’s debt-to-GDP ratio rose to about 270 percent this year, they added.

Also, investors did not react to the higher industrial profits, which jumped 14.5 percent in November to 774.6 billion yuan, up from 9.8 percent increase in October.

Meanwhile, People's Bank of China sets the USD/CNY reference rate at 6.9462, weaker than Monday’s 6.9459. The China's blue-chip CSI300 index traded 0.07 percent higher at 3,324.54 points, while the Shanghai Composite Index traded marginally lower, falling 0.04 percent to 3,121.47 points.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed