Even after last week's bounce back, China's stock market is nearly 30% below its early June highs, with close to US$3trn of wealth destroyed, on paper. The Chinese stock market is still up nearly 15% in the year to date and 82% for the past 12 months.

"Yet although the mark-to-market losses are striking, we do not expect a significant impact on China's economy," notes Barclays.

Moreover, we doubt that there is much of a wealth effect to begin with. Chinese households hold only a fraction of their wealth in the stock market; real estate is a far more important asset class, and high levels of household savings smooth out consumption patterns.

The 2007-08 boom and bust in Chinese equities had little impact on consumption, retail sales or industrial production. Moreover, capital markets are not a significant source of financing for China's corporate sector, on either the equity or debt side. Although the financial services sector contributed a not insignificant 1.4pp to Chinese GDP growth in 2Q1 2015, it is not big enough to detract sharply from Chinese growth, even if stocks drop further.

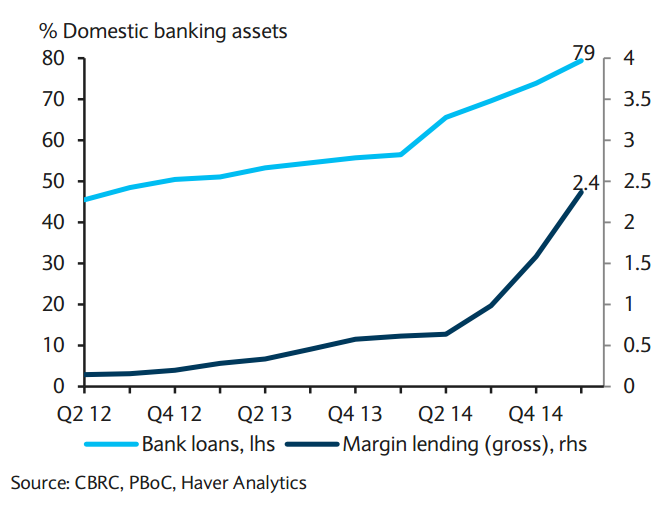

We also find few signs of contagion to the Chinese banking sector. Although margin financing provided by securities firms and the 'shadow financing' sector played a role in the equity run-up, the total financing provided seems to be around 6trn yuan. By contrast, the Chinese banking sector has over 100trn yuan in assets, with very little margin lending exposure; the bulk is bank loans.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data