Chinese stock market is the most volatile in the world. At the peak of the crash, 5 day average of realized volatility reached close to 10% for its benchmark stock index Shanghai Composite. It has fallen substantially over intervention but still around 4%, still high compared to global standard

In a bid to better manage its currency, Chinese central bank devalued Yuan resulting in a spill-over of volatility across global market, especially in European equity markets.

- Emerging market currencies along with mining stocks are being hammered all across globe, as fear is rising for hard landing in China. China might be weaker than many had originally assumed and there is a growing risks that in spite of denial by People's bank of China (PBoC), there could be further devaluation even market driven one.

- Chinese devaluation of Yuan for three consecutive days last week, clouded monetary policy and its effect from European Central Bank (ECB) and raised the risk of currency war.

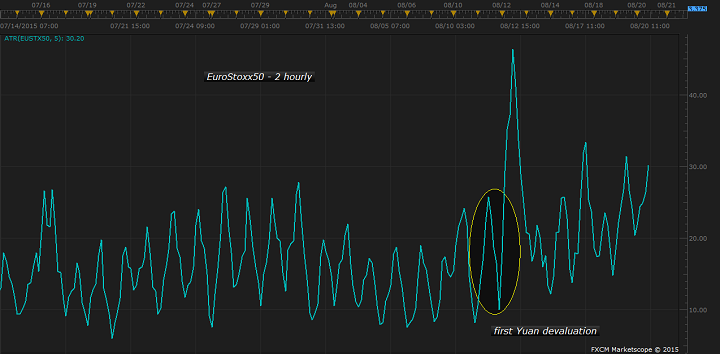

European blue chip index, EuroStxx50 registered substantial rise in volatility. 5 day average of realized volatility has almost doubled, both daily and intraday.

5 day average of daily realized volatility is up from around 1% before intervention to 1.8% as of today and 2 hourly volatility jumped from 0.5% to 0.9%, while the index lost about 8.5% since the intervention.

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play