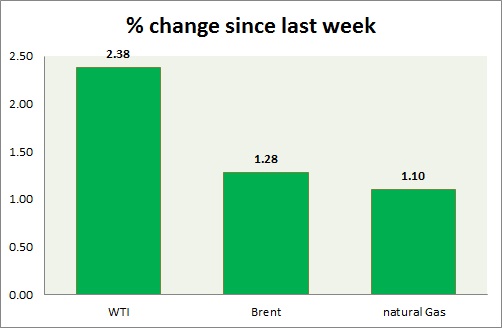

Energy pack is up today over escalating violence in Middle East. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI is up today after eight days of consecutive drop as France steps up its bombing raid against ISIS. Today's range $40.6-41.6

- However any major bounce back seem limited at this point.

- WTI is currently trading at $41.6/barrel. Immediate support lies at 38 area and resistance at $45, $47.5 area.

Oil (Brent) -

- Despite Brent being the benchmark of the region affected, WTI is better performer. Today's range - $45.2-44.4

- Brent-WTI spread dropped to $3.4/barrel from $4/barrel on Friday.

- Brent is trading at $45/barrel. Immediate support lies at $42 area and resistance at $48, $50.5, 54 region.

Natural Gas -

- Natural gas is sharply up today, winter is finally seem to be making way to price. Sellers however, pushed back prices heading into New York session. Today's range $2.37-2.46

- Buy Natural gas @2.4, targeting $3.15/mmbtu and stop loss at $2.1/mmbtu.

- Natural Gas is currently trading at $2.39/mmbtu. Immediate support lies at $2, $1.85 area & resistance at $2.4.

|

WTI |

+2.38% |

|

Brent |

+1.28% |

|

Natural Gas |

+1.10% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate