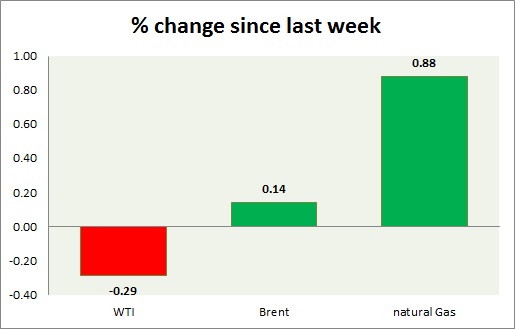

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table,

Oil (WTI) –

- Oil price remains elevated as a report came out suggesting Saudi Arabia targeting $100 per barrel and thanks to geopolitical tensions. Today’s range - $68-$67.1

- WTI is currently trading at $67.9/barrel. Immediate support lies at $63 area and resistance at $69area.

Oil (Brent) –

- Brent remains elevated over WTI due to higher demand, geopolitical tension and OPEC agreement. Today’s range - $74.5-75.3

- Brent is trading at $5.9 per barrel premium to WTI.

- Brent is trading at $73.8/barrel. Immediate support lies at $66 area and resistance at $74 region.

Natural Gas –

- Natural gas is continuing its struggle as winter end arrives. Today’s range $2.75-2.80

- Natural Gas is currently trading at $2.76/MMBtu. Immediate support lies at $2.45 area & resistance at $2.78, and $2.90

|

WTI |

-0.29% |

|

Brent |

+0.14% |

|

Natural Gas |

+0.88% |

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022