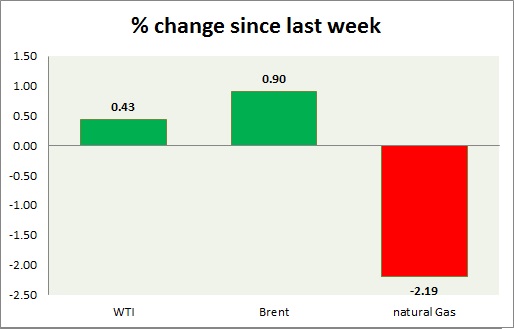

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table,

Oil (WTI) –

- Oil price is struggling as trade tensions weigh on demand, especially the deterioration in relations between Turkey and the U.S. and the weakness in the emerging markets. However, lower inventory is pushing prices higher Today’s range - $69.5-$70.2

- WTI is currently trading at $70.1/barrel. Immediate support lies at $64 area and resistance at $72 area.

Oil (Brent) –

- Brent remains elevated over WTI due to higher demand, geopolitical tension and OPEC agreement. Today’s range - $77.3-78.5

- Brent is trading at $8.2 per barrel premium to WTI.

- Brent is trading at $78.3/barrel. Immediate support lies at $73 area and resistance at $79 region.

Natural Gas –

- The bounce back from $2.7 area seems to be over as the price declines from $3 resistance area again after a failed attempt to break. Today’s range $2.81-$2.92

- Natural Gas is currently trading at $2.86/MMBtu. Immediate support lies at $2.78 area & resistance at $2.95

|

WTI |

+0.43% |

|

Brent |

+0.90% |

|

Natural Gas |

-2.19% |

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022