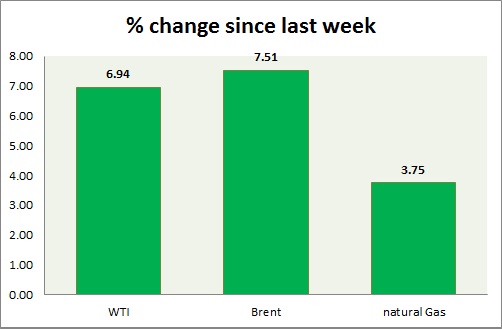

Energy segment continue to find sellers at rallies. Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI selloffs continued as supply concerns persist. WTI has reached initial target of $42.5/ barrel further loss can't be ruled out and prices might move towards 2008 crisis low. Today is seventh consecutive decline. EIA reported an increase in inventory by 9.6 million barrels. WTI is currently trading at $42.2/ barrel, down nearly 3% today. Immediate support lies at 42, 38 and resistance at 46, 48.3.

- Oil (Brent) - Brent continued fall but at a moderate rate than peers. Brent-WTI spread is trading at $ 11, support lies at $8 and resistance at $13. Brent has reached the initial target of $53. Brent is trading at $53.3/barrel. Immediate support lies at 53, 50, 47 & resistance at 56, 58.4.

- Natural Gas - Natural gas is having quite a volatile week as markets waits for this week's inventory report as it fell below 5 year average. Natural Gas is currently trading at 2.83/mmbtu. Immediate support lies at 2.65 & resistance at 2.87.

|

WTI |

-6.08% |

|

Brent |

-2.06% |

|

Natural Gas |

4.04% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary