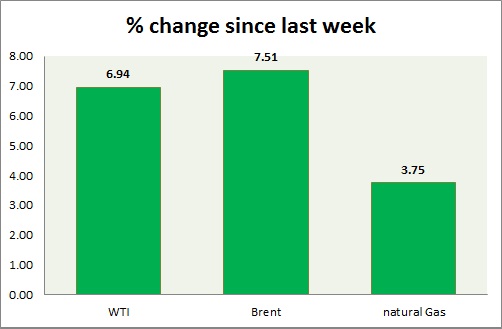

Energy segment is once again hit by selling as prices failed to break above key resistance last week. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI fell close to -1.5% today, as supply remains of greater concern than Middle East tension.

- WTI might continue to tread waters until further clarity appears.

- Bulls are retracing after reaching first bullish target of $51 and just short of second target at $54 last week.

- Target to the downside is coming around $45.

- WTI is currently trading at $48.25/barrel. Immediate support lies at 47.5-47, 44-43.7 and resistance at 51.7-52.1, 54-54.5, 58.7-59.2.

Oil (Brent) -

- Brent fell but performed worse than WTI.

- Brent-WTI spread narrowed after since last week, trading at $ 7.2/barrel, might go further down if Iran deal come out successful.

- Brent is trading at $55.4/barrel, down -1.35% today. Bias is downwards. Immediate support lies at 53 & resistance at 59.6-60.

Natural Gas -

- Natural gas is trading near range low. Price is lacking direction.

- Price pattern suggests that prices might drop down towards $2.44/mmbtu.

- Approaching summer is weighing on price, however talks of higher intake by power producers has kept the price supported.

- Natural Gas is currently trading at 2.65/mmbtu, flat today. Immediate support lies at 2.65, 2.55 & resistance at 2.74, 2.91, and 3.02.

|

WTI |

-0.12% |

|

Brent |

-1.20% |

|

Natural Gas |

-0.08% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary