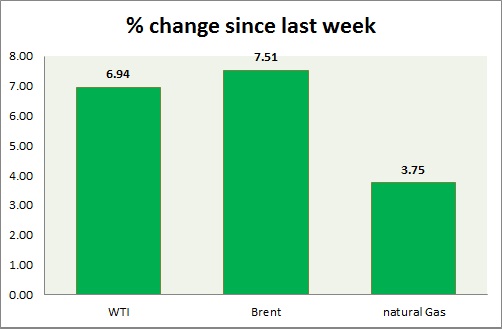

Energy segment's performance is mixed today, oils are up while gas is down. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI is trying to pose a comeback amid oversupply in US, however struggling to do so until.

- Bulls are lacking conviction and inventory continue to rise at record pace in US.

- WTI is currently trading at $51.4/barrel, up 1.2% today. Immediate support lies at $49.8-49.5, $47.5-47 and resistance at $54-54.5, and $58.7-59.2.

Oil (Brent) -

- Brent continue to trade sideways between $56 and $58.

- Brent-WTI spread flat today, trading at $6/barrel. Lacking conviction. Next week might provide fresh start.

- Brent is trading at $57.4/barrel. Downtrend remains in play. Immediate support lies at $54.5-53 area and resistance at $ 59.4-60.2 region.

Natural Gas -

- Natural gas is the worst performer this week. Current downtrend might push prices lower, however for now bids remain large around $2.54/mmbtu -$2.50/mmbtu zone.

- Price pattern suggests that prices might drop down towards $2.44/mmbtu. Short term traders are advised to book some profits and sell rallies next week. Weaker intake over summer might push price lower towards $2.2/mmbtu.

- Natural Gas is currently trading at 2.53/mmbtu, down 0.4% today. Immediate support lies at 2.50 area & resistance at $2.71, 2.81.

|

WTI |

+3.86% |

|

Brent |

+3.97% |

|

Natural Gas |

-6.16% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate