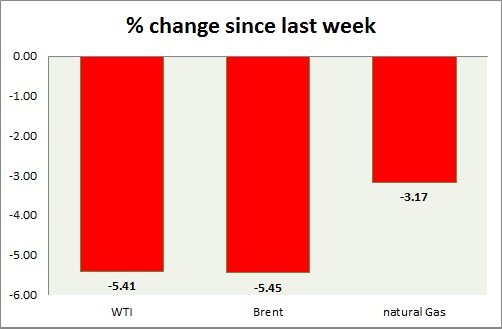

Energy pack is down in today’s trading. Weekly performance at a glance in chart & table.

Oil (WTI) –

- WTI marginally down, despite weakness in the dollar as large gasoline inventory weighs. Active call – WTI is likely to drop towards $35 area. Today’s range $41.6-42.2

- WTI is currently trading at $41.8/barrel. Immediate support lies at $35.5 area and resistance at $45, $50.2, $52 area.

Oil (Brent) –

- Brent is down in line with WTI. Today’s range - $42.8-43.7

- Brent is trading at $1.4 per barrel premium to WTI.

- Brent is trading at $43.2/barrel. Immediate support lies at $44 area and resistance at $54 region.

Natural Gas –

- Natural gas is best performer today and this week but in red like oil. We expect natural gas to go down around $2.2 area, before it goes to $4.3 area. Today’s range $2.64-2.7

- Natural Gas is currently trading at $2.69/mmbtu. Immediate support lies at $2.4, $2.6 area & resistance at 2.95 and $3.1

|

WTI |

-5.41% |

|

Brent |

-5.45% |

|

Natural Gas |

-3.17% |

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022