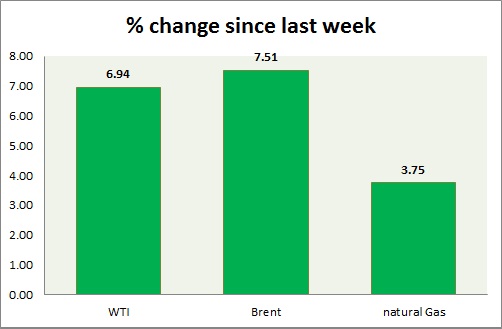

Energy segment has rebounded sharply since yesterday. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI is now trading close at $ 54 area, price looks to be breaking out, however stronger dollar today is hindering oil's progress. They might shoot up, should dollar weaken considerably.

- Bulls might once again move to test $54-54.5 area. Breakout of the area would push prices higher towards $60 as initial target area.

- WTI is currently trading at $54.1/barrel, up 2% today.

Immediate support lies at $51.2-50, $47.5-47 and resistance at $54-54.5, and $58.9-59.7.

Oil (Brent) -

- Brent has appreciated sharply since yesterday and verge of taking out the resistance. Further appreciation can't be ruled out.

- Brent-WTI spread moved jumped yesterday over late night trading, currently trading at $6.3/barrel. Bears lost control again, both lacking clear conviction.

- Brent is trading at $60.3/barrel. Downtrend intact. Immediate support lies at $58-57 area and resistance at $ 62.6-64 region.

Natural Gas -

- Natural gas bounce back gathered further pace today, now trading around $2.47/mmbtu this week. Up 1.60% today so far.

- Natural Gas is currently trading at 2.56/mmbtu. Immediate support lies at $2.12 area & resistance at $2.60, 2.71.

|

WTI |

+4.82% |

|

Brent |

+4.23% |

|

Natural Gas |

+2.15% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?