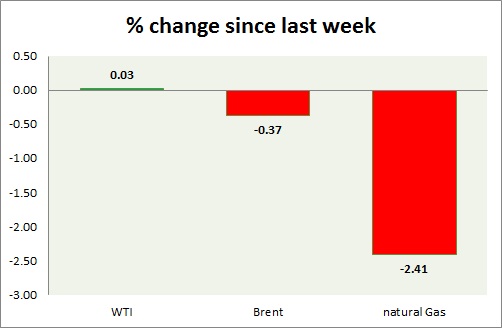

Energy segment is trading in red today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI is struggling to make further gains $60 looks to be initial target, partial profit booking is recommended and next target is coming around $63-$65 area.

- Dovish FOMC and weaker dollar might provide further ammunition. EIA stock details would be important focus.

- WTI is currently trading at $57.3/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $58.9-59.7, $64-$65

Oil (Brent) -

- Since last week, Brent has outperformed WTI, as larger crude imbalance remains an US phenomenon. Price has cleared resistance around 65 area. Further gains seems to be on card.

- Brent-WTI moving up, currently trading at $7.8/barrel. Brent might be targeting $69.6-$70 level as initial target.

- Brent is trading at $65.2/barrel. Immediate support lies at 61.8-61.4, $58-57 area and resistance at $ 70 region.

Natural Gas -

- Natural gas is once again worst performer. Price has reached initial target around $2.44/mmbtu.

- Next price target is coming close to $2.15/mmbtu. Traders should be prepared for higher volatility. Resistance around $2.84 remains crucial.

- Natural Gas is currently trading at 2.47/mmbtu. Immediate support lies at $2.12 area & resistance at $2.71.

|

WTI |

+-0.03% |

|

Brent |

-0.37% |

|

Natural Gas |

-2.41% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary