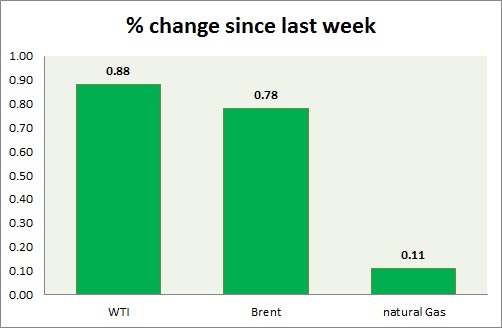

Energy segment is mixed in today's trading with oil gaining and gas losing ground. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI is struggling to break $60 as crude stocks continue to pile up. Partial profit booking is recommended. Crude might still be targeting $63-$65, however bulls are looking for catalyst to break above current level.

- EIA stocks on Wednesday and NFP report on Friday remain the focus. Weaker dollar might even lead crude towards $70 level.

- WTI is currently trading at $59.7/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $58.9-59.7, $64-$65

Oil (Brent) -

- Brent has been outperforming WTI in recent trades, as intense fighting in Yemen, close to port of Aden is giving rise to tensions. Brent might rise further.

- Brent-WTI moving sideways, currently trading at $7.3/barrel. Brent might be targeting $69.6-$70 level as initial target.

- Brent is trading at $67/barrel. Immediate support lies at $63.7-63.2, 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas moved up more than 10% last week. Prices rebound from support and target area of $2.44/mmbtu. Bulls are now in control, however that might shift soon enough.

- Bulls need to break above $2.85-$2.9 area to diminish downside bias significantly.

- Natural Gas is currently trading at 2.77/mmbtu. Immediate support lies at $2.44 area & resistance at $2.86.

|

WTI |

+0.88% |

|

Brent |

+0.78% |

|

Natural Gas |

+0.11% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand