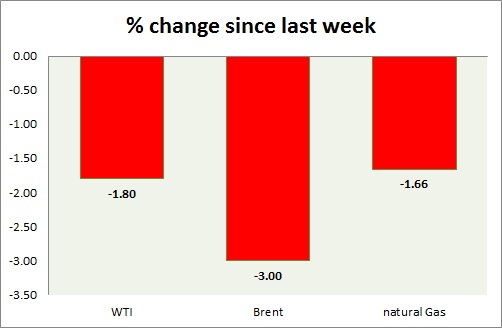

Energy pack is trading in green today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI moved up taking interim support at $58. However further downside remains open.

- API inventory report showed another drawdown of 5 million barrels. EIA report is due at 14:30 GMT.

- WTI carved bearish doji in weekly chart and very bearish grave stone doji in daily chart. Further downside remains open if doji high is not taken out. RSI is also around 50 level resistance.

- WTI is currently trading at $58.8/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $63-$65. $58 may continue to provide interim support.

Oil (Brent) -

- Brent moved higher in early Asian trade, however failed to move beyond initial buying. Focus remains on today's NFP report.

- Brent-WTI spread flat today, currently trading at $6.1/barrel.

- Brent is trading at $64.9/barrel. Immediate support lies at $63.7-63.2, 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas gave large correction over profit booking after trading as high as 3.11/mmbtu yesterday.

- Price target for bulls are coming close to $3.5/mmbtu, should support at $2.45 holds. Averaging it as low as possible would diminish risk.

- Natural Gas is currently trading at $3.06/mmbtu. Immediate support lies at $2.78 area & resistance at $3.32.

|

WTI |

-1.80% |

|

Brent |

-3.00% |

|

Natural Gas |

-1.66% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings