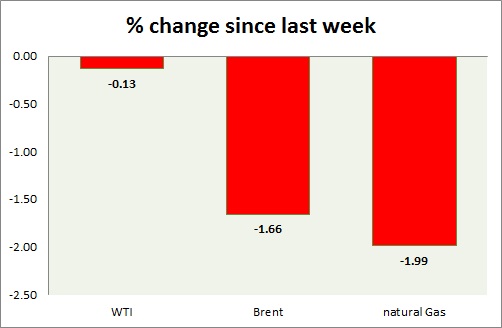

Energy pack is in consolidation mode. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI moved higher taking cues from FED minutes as rate hike seem to be pushed and $58 provided the necessary support.

- WTI carved bearish doji in weekly chart and very bearish grave stone doji in daily chart. Further downside remains open if doji high is not taken out. RSI is also around 50 level resistance.

- WTI chart shows that prices might be curving a top.

- WTI is currently trading at $59.8/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $63-$65. $58 may continue to provide interim support.

Oil (Brent) -

- Brent moved similar to WTI, however slightly lagging.

- Brent-WTI dropped 10 cents today, currently trading at $6/barrel. Further downside remains open.

- Brent is trading at $65.8/barrel. Immediate support lies at $63.7-63.2, 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas in the short term has broken upward sloping trend line, suggesting that correction might be larger. Bulls are likely to use opportunity to buy at dips. Focus is on today's inventory report.

- Higher inventory will lead to lower price, so dip buying remains opportunity.

- Price target for bulls are coming close to $3.5/mmbtu, should support at $2.45 holds. Averaging it as low as possible would diminish risk.

- Natural Gas is currently trading at $2.95/mmbtu. Immediate support lies at $2.78 area & resistance at $3.32.

|

WTI |

-0.13% |

|

Brent |

-1.66% |

|

Natural Gas |

+1.99% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings