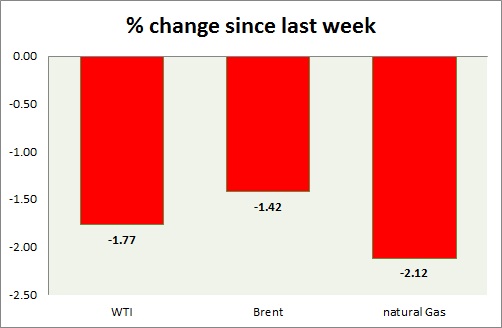

Energy pack is taking a hit today amid stronger dollar. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI traded as high as $60, however failed once more to clear above. Declined towards $58/barrel in New York session.

- WTI carving several bearish doji in weekly chart and in daily chart. Further downside remains open if doji high is not taken out.

- WTI chart shows that prices might be curving a top. $58 support area, proving to be crucial.

- WTI is currently trading at $58.8/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $63-$65. $58 may continue to provide interim support.

Oil (Brent) -

- Brent move is similar to WTI, however weaker. Supply still remains at least 2 million barrels/day above demand.

- Brent-WTI lost 20 cents today, currently trading at $6/barrel. Brent might do well compared to WTI this week.

- Brent is trading at $64.6/barrel. Immediate support lies at $63.7-63.2, 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas consolidating near $2.78 support area. A break below would dent bullish momentum for the time being. As of now further downside seems likely.

- Price target for bulls are coming close to $3.5/mmbtu, should support at $2.45 holds. Averaging it as low as possible would diminish risk.

- Natural Gas is currently trading at $2.82/mmbtu. Immediate support lies at $2.78, $2.68 area & resistance at $3.04, $3.32.

|

WTI |

-1.77% |

|

Brent |

-1.42% |

|

Natural Gas |

-2.12% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary