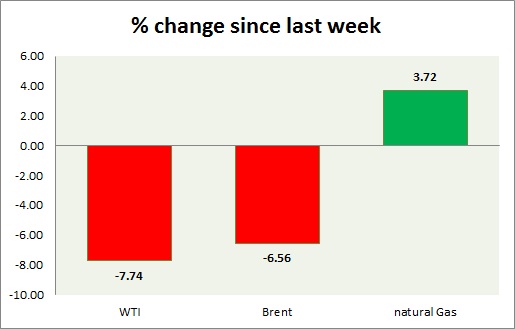

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table.

Oil (WTI) –

- WTI suffered a major slump yesterday as inventories continue to rise in the US. Today’s range $50.9-48.8

- With an OPEC and non-OPEC deal done, the oil price is likely to reach $59 and $68 per barrel. However, WTI might decline to $46 per barrel in the short term.

- WTI is currently trading at $49.2/barrel. Immediate support lies at $49 area and resistance at $54 area.

Oil (Brent) –

- Brent is marginally better performer than WTI this week. Today’s range - $53.9-51.6

- Brent is trading at $2.9 per barrel premium to WTI. Likely to widen further in the medium term.

- Brent is trading at $52.1/barrel. Immediate support lies at $52 area and resistance at $56 region.

Natural Gas –

- Natural gas target $2.3 per MMBtu. Sell here at $2.9 per MMBtu. Today’s range $2.88-2.94

- Natural Gas is currently trading at $2.92/mmbtu. Immediate support lies at $2.5 area & resistance at $2.9 and $3.1

|

WTI |

-7.74% |

|

Brent |

-6.56% |

|

Natural Gas |

+3.72% |

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed