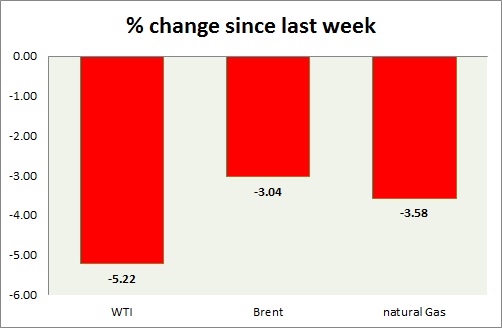

Energy pack is mixed, while oil is up, gas is in red. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI likely to maintain downside as 8 week range got broken to downside last week.

- WTI bounced back from support area around $50, likely to drop further. Today's range $53.5-51.5

- Target for the downside is reached around $50-51/barrel, a further fall towards $42 seems likely.

- WTI is currently trading at $52.7/barrel. Immediate support lies at $51.2-50 and resistance at $54

Oil (Brent) -

- Brent likely to maintain downside as support near $61 got cleared last week. Approaching Iran deal is weighing on price.

- Brent has bounced back from support area of $55, though further drop is likely.

- Brent-WTI spread gained 70 cents today, currently trading at $5.9/barrel. Spread rose as expected as Iran deal still remained elusive.

- Target is reached around $55/barrel, and next target is around $51/barrel.

- Brent is trading at $58.6/barrel. Immediate support lies at $55 area and resistance at $59 region.

Natural Gas -

- Natural gas is likely to drop further as Bulls failed to clear resistance at $2.85 and bears have cleared $2.7 support area.

- Price target for Natural gas to downside is $2.55, $2.45 and $2.35 with stop around $2.85

- Natural Gas is currently trading at $2.67/mmbtu. Immediate support lies at $2.55, $2.45 area & resistance at $2.85, $2.93, $3.04, $3.32.

|

WTI |

-5.22% |

|

Brent |

-3.04% |

|

Natural Gas |

-3.58% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings