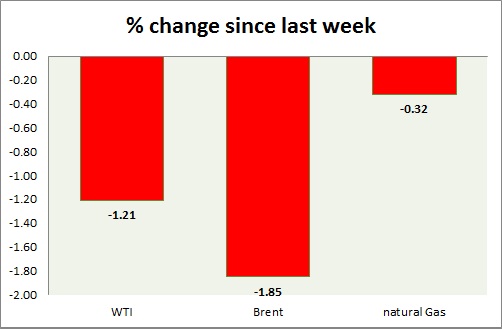

Energy pack is down today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI falls further over China's concern as stocks drop at sharpest pace since 2007. Today's range $48.2-47.2

- WTI is likely to fall towards $42 area. The drop might extend below $40 area. $45 will serve as interim support.

- WTI is currently trading at $47.5/barrel. Immediate support lies at $50 and resistance at $54

Oil (Brent) -

- Brent is worse performer than WTI, as OPEC keeps pumping.

- Brent-WTI spread dropped by 90 cents since yesterday, currently trading at $6.1/barrel.

- Next target is around $51/barrel as support around $55/barrel got cleared.

- Brent is trading at $53.6/barrel. Immediate support lies at $50 area and resistance at $57 region.

Natural Gas -

- Natural gas bulls retreated sharply last week after failing at key resistance around $2.95 however trying to make a comeback today. Today's range $2.83-2.725.

- Price might reach as low as $2.35 if it clears $2.7 mark.

- Natural Gas is currently trading at $2.79/mmbtu. Immediate support lies at $2.55, $2.45 area & resistance at $2.95, $3.04, $3.32.

|

WTI |

-1.21% |

|

Brent |

-1.85% |

|

Natural Gas |

-0.32% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary