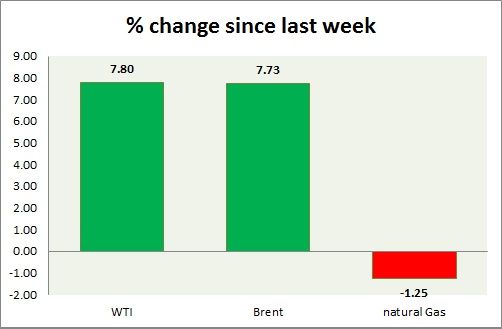

Energy pack is mixed today, while oil is up gas is down. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI is sharply gaining today continuing three consecutive days of short covering. Today's range $43.5-49.3

- Buy oil targeting $53/barrel area.

- WTI is currently trading at $49.1/barrel. Immediate support lies at $43 area and resistance at $53 area.

Oil (Brent) -

- Brent rose along with WTI on global risk recovery. Today's range - $48.2-54.3.

- Brent-WTI spread rose to $5/barrel.

- Brent is trading at $54.1/barrel. Immediate support lies at $48 area and resistance at $54.5, 59 region.

Natural Gas -

- Natural gas continues to find resistance around $2.7/mmbtu and likely to drop further, unless resistance cleared. Today's range $2.72-2.63.

- Price likely to drop to $2.35/mmbtu, since support cleared. However $2.63 area proving to be strong support.

- Natural Gas is currently trading at $2.68/mmbtu. Immediate support lies at $2.55, $2.45 area & resistance at $2.75, $2.95, $3.04, $3.32.

|

WTI |

+7.80% |

|

Brent |

+7.73% |

|

Natural Gas |

-1.25% |

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000