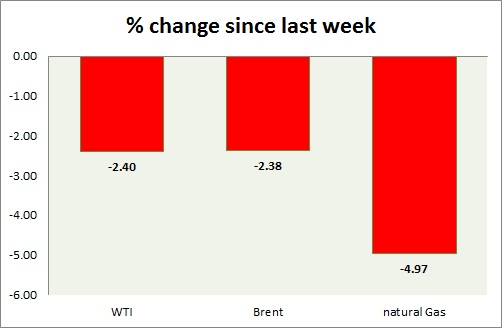

Energy pack is trading in red today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI is down today but continuing its consolidation, however market squeeze suggests breakout ahead. Today's range $45.8-44.1

- WTI is currently trading at $44.3/barrel. Immediate support lies at $43.3, $41.5 area and resistance at $48 area.

Oil (Brent) -

- Brent is down in line with WTI today, relatively worse performer. Today's range - $48.5-47.

- Brent-WTI spread is at $2.9/barrel.

- Brent is trading at $47.2/barrel. Immediate support lies at $45 area and resistance at $52.5, 59 region.

Natural Gas -

- Natural continuing its drop for fourth consecutive day. Today's range $2.45-2.4.

- Natural Gas is currently trading at $2.43/mmbtu. Immediate support lies at $2.5, $2.45 area & resistance at $2.75, $2.95, $3.04, $3.32.

|

WTI |

-2.40% |

|

Brent |

-2.38% |

|

Natural Gas |

-4.97% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate