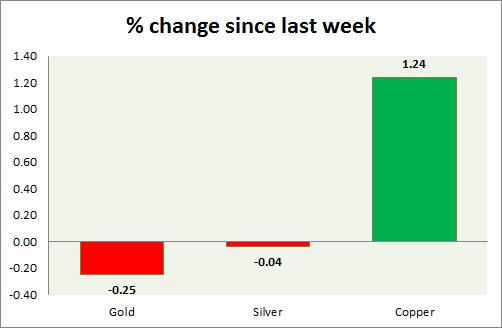

Metals are mixed in today's trading, precious pack is down while industrial is up. Performance this week at a glance in chart & table -

Gold -

- Gold gave up some gains amid stronger dollar. Gold tested $1224 resistance yesterday, however failed to break above such. It now might test the support around $1200 and $1190.

- Gold is currently trading at $1213, down 0.15% today. Immediate support lies at $1193, $1178, $1160 and resistance at $1224 and $1236-1240 area.

Silver -

- Silver performed worse than gold today sellers continue to push price downwards.

- Mint ratio is up 0.56% today, currently at 71.94. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $17.1/troy ounce, up 2.75% today. However bigger trend remains downwards. Support lies at 15.42,14 & resistance at 17.5-17.7.

Copper -

- Copper gained grounds today after yesterday's massive sell offs. Price bounced back from $2.71 intraday. Price is up close to 2 % today.

- Current move suggest bears are in full control around $2.8-2.92 area. Downside target is coming around $2.52, with a stop of $2.84, upside can still be played with target around $3.1 with stop of $ 2.45.

- Bearish inverted hammer is in play in weekly chart.

- Copper is currently trading at $2.77/pound. Immediate support lies at 2.59 & resistance at 2.85, 2.93, and 3.07.

|

Gold |

1.08% |

|

Silver |

1.12% |

|

Copper |

1.43% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary