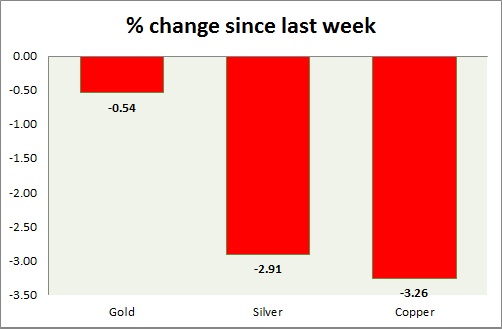

Metals remained lackluster amid weaker dollar today in New York session. Performance this week at a glance in chart & table -

Gold -

- Gold is trading in a small range today, as bulls keep providing support around $1193 and bears around $1200. Range to continue as direction lacks.

- Price might move towards $1152 and $1133 level should price remain capped within $1224.

- Gold is currently trading at $1198, down -0.15% today so far. Immediate support lies at $1178, $1160 and resistance at $1224 and $1236-1240 area.

Silver -

- Bears pushed silver below $16 level, bull's comeback were halted around $16.2 area. Bears might push towards $13-$11 level.

- Mint ratio is up 0.23%, currently at 75.1. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $15.9/troy ounce, down -0.10% today. Support lies at 15.42,14 & resistance at 17.5-17.7.

Copper -

- Copper is the worst performer this week, facing headwinds over weaker growth in China.

- Bias remains downwards with stop of $2.85 and target of $2.52-$2.47

- Bearish inverted hammer and bearish doji remains in play in weekly chart.

- Copper is currently trading at $2.70/pound, down -0.74% today, immediate support lies at $2.59 & resistance at $2.85, 2.93, and 3.07.

|

Gold |

-0.54% |

|

Silver |

-2.91% |

|

Copper |

-3.26% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand