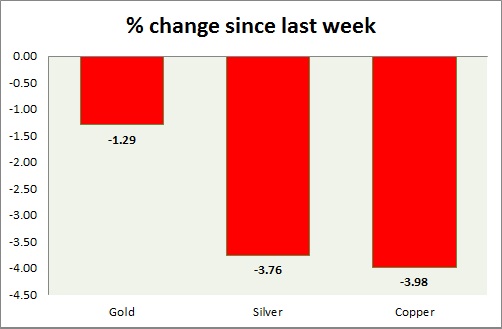

Metals are worst performer this week among asset class. Performance this week at a glance in chart & table -

Gold -

- Gold has fallen lower after bulls were halted at $1204 level, moved towards $1185 low so far.

- Price might move towards $1152 and $1133 level should price remain capped within $1224.

- Gold is currently trading at $1189, down -1.06% today so far. Immediate support lies at $1178, $1160 and resistance at $1224 and $1236-1240 area.

Silver -

- Silver is the worst performer today, as price traded as low as $15.59. Price is very close to support might get a bounce back from it. However trend remains downwards as price targets close to $14 and $12 as next.

- Mint ratio is up 0.22%, currently at 75.2. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $15.8/troy ounce, down -1.24% today. Support lies at $15.42, $14 & resistance at $16.3-$16.6, $17.5-17.7.

Copper -

- Copper continue to move lower towards target, however beware of volatility.

- Bears remain in control. Trade was suggested with stop of $2.85 and target of $2.52-$2.47

- Bearish inverted hammer and bearish doji remains in play in weekly chart.

- Copper is currently trading at $2.68/pound, down -0.37% today, immediate support lies at $2.59 & resistance at $2.85, 2.93, and 3.07.

|

Gold |

-1.29% |

|

Silver |

-3.76% |

|

Copper |

-3.98% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings