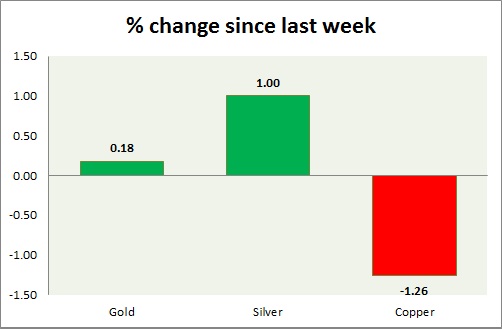

Precious pack is trading in green today. Performance this week at a glance in chart & table -

Gold -

- Gold has $1224 resistance area, however hovering at the area as of now.

- Next target for Gold is coming at $1252.

- Gold is currently trading at $1226/troy ounce. Immediate support lies at $1208, $1178 and resistance at $1236-1240 area.

Silver -

- Silver is yet not broken resistance area of $17.5-$17.7 however most likely to break above. A clear break would push silver higher around $18.5-19 as first target.

- Mint ratio is down -0.69% today, currently at 69.35. Mint ratio and precious metal prices are inversely related more often than not. Ratio indicating further rise in prices,

- Silver is currently trading at $17.65/troy ounce. Support lies at $16, $15.42 & resistance at $17.5-17.7, 18.4-18.7.

Copper -

- While precious advance copper bulls failed to break above key resistance around $2.95. Chinese slowdown remains a concern for industrial metals.

- Bulls remain in control, however a correction is very likely as bulls struggled for 3 weeks to break above the resistance.

- Copper is currently trading at $2.89/pound, immediate support lies at $2.86, $2.76 & resistance at $2.95, $3.07.

|

Gold |

+0.18% |

|

Silver |

+1.00% |

|

Copper |

-1.26% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?