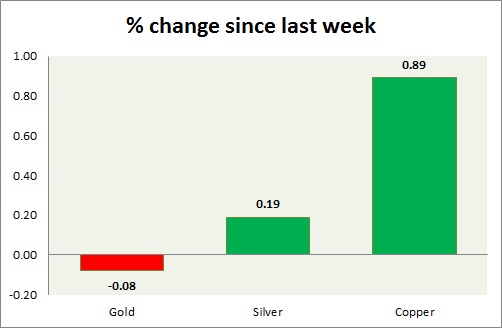

Metals are trading in low volatility as key markets are closed today. Performance this week at a glance in chart & table -

Gold -

- In spite of large gains in US dollar, gold has been able to hold on above $1200.

- Bulls and bears are broadly in balance with bulls targeting $1252 and bears $1154.

- Gold is currently trading at $1205/troy ounce. Immediate support lies at $1200, $1178 and resistance at $1224, $1236-1240 area.

Silver -

- Silver's strength waned on the final day last week. Short side remains open as price has failed to clear resistance area near $17.5.

- Mint ratio is flat today, currently at 70.4. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $17.1/troy ounce. Support lies at $16, $15.42 & resistance at $17.5-17.7, 18.4-18.7.

Copper -

- Copper clawing some ground back over profit, after last week's massive selloffs.

- Bears remain in control in short term since $2.95 held strong.

- Copper is currently trading at $2.82/pound, immediate support lies at $2.76 & resistance at $2.95, $3.07. $2.89 would provide interim resistance.

|

Gold |

-0.08% |

|

Silver |

+0.19% |

|

Copper |

+0.89% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?