Everybody is talking about crude oil, whether the person is a trader, investor, politician, industrialists ot just a common man.

Crude oil and its price is so interlinked with global economy it's simply impossible to ignore, which makes it ever more crucial to know, where the price is headed?

While lower crude price from current level (WTI - $40.6/barrel) it will create havoc for oil producers as well as global inflation, on the other emerging economies with their weak currencies are totally not prepared for sharp rise in oil.

Recently many analysts and economists with current supply glut in oil price have been calling for further low price in crude oil pointing to $30/barrel or even $15/barrel.

Are these prices even possible?

- Sure, but for that key question needs to be answered.

What is the key question?

- Key question brings us asking another question- why crude price dropped? Is it overproduction from OPEC. Clearly NO. Its shale oil boom in US, which has made the nation one of the largest producer of oil and still rising above 9.5 million barrels/day.

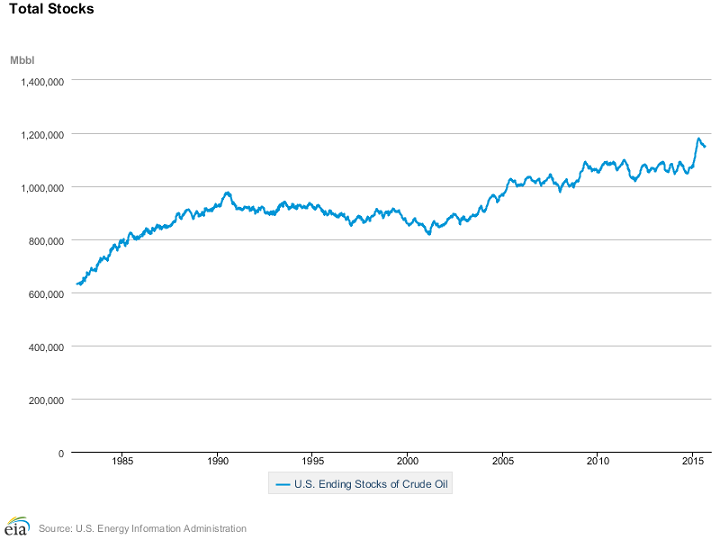

- That brings us to the key question - With US economy slowly moving away from oil into renewables and gas what will happen to US oil and more than 1 billion barrels of oil reserve (including strategic petroleum reserve.)

A bill to free up US oil exports in crude form is already lurking in the senate. Keeping close watch. Next US President might as well free it up.

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth