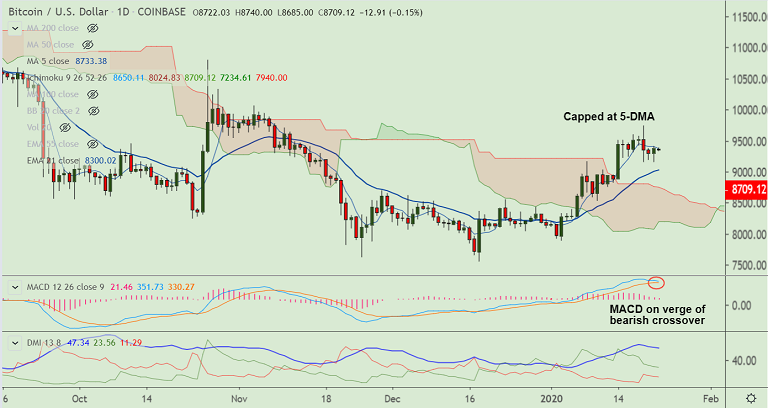

BTC/USD chart - Trading View

Exchange - Coinbase

Technical Analysis: Bias Neutral

GMMA Indicator: Major Trend - Bullish; Minor Trend - Neutral

Overbought/ Oversold Index: Neutral

Volatility: Shrinking

Support: 8350 (Trendline); Resistance: 9003 (200-DMA)

BTC/USD was trading largely rangebound on the day at 8717 at around 05:00 GMT, bias remains neutral.

The pair edged higher from session lows at 8465 in the previous session to close 1.08% higher at 8722.

Price action is however, struggling to extend recovery as 'Death Cross' on the hourly charts weighs.

That said, major and minor trend as evidenced by the GMMA indicator are bullish, scope for upside resumption.

Pullbacks in the pair has held above channel top (8350), retrace below will negate near-term bullish bias.

Upside in the pair finds stiff resistance at 200-DMA and breakout required for upside continuation.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary