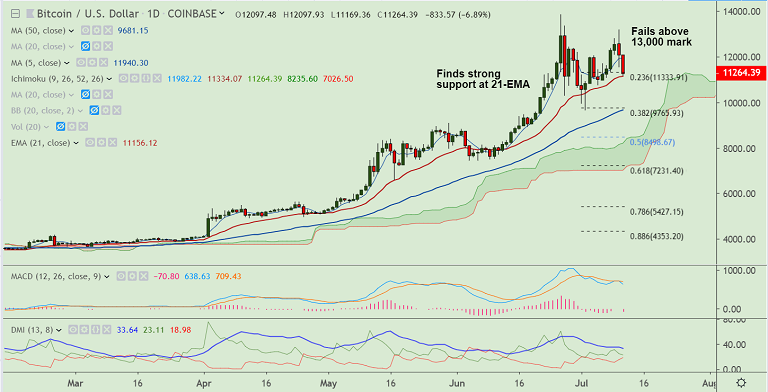

BTC/USD chart - Trading View

Exchange - Coinbase

Support: 11156 (21-EMA); Resistance: 12000

Technical Analysis: Major trend remains bullish, intraday bias turning slightly bearish

BTC/USD sold off above $13,000, hits new weekly lows at $11,169.

The pair finds strong support at 21-EMA (11156), decisive break below will see further weakness.

Major trend in the pair remains bullish. We do not see any major signs of reversal yet.

Price action has edged lower after testing upper Bollinger band. Break below 21-EMA could see drag till lower Bollinger band (10140).

The pair has slipped below 200 SMA on the 1H and 2H charts. Dips accompanied by strong volumes may be a concern for bulls.

Fundamental reasons behind the sell-off still unknown. Profit taking at highs is likely to have triggered the move.

GMMA indicator still shows upside on the weekly and daily charts. A potential 'Gravestone' Doji on the weekly charts could add to the bearish bias.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.