After BTCUSD has bottomed out at $3,122.28 levels, the pair has surged to the June highs of $13,880 levels which is almost more than 344% so far (in just 6-7 months or so, refer monthly chart). It has halted the vigorous rallies and turned bearish again to plunge back towards $10k levels.

The position proxy suggests that Bitcoin is still overbought despite some position reduction in July. After peaking at the end of June, Bitcoin has been struggling in July raising questions about overbought conditions.

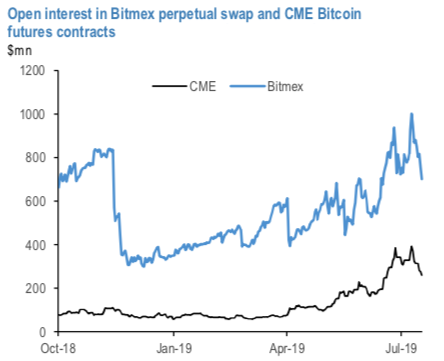

To address this question, we resort to futures contracts and in particular, the two most important Bitcoin futures contracts: the CME futures contract and the less regulated perpetual swap contract traded at Bitmex. Both of these contracts are mostly driven by institutional investors. We argued before that the relative importance of institutional investors has structurally risen for the Bitcoin market over the past year as the previous cryptocurrency bubble of 2017 collapsed during last year, inducing many retail investors to exit the market.

How big are the above contracts? The above chart depicts the open interest of these two contracts. The open interest is more than double at Bitmex (around $700mn currently vs. around $300mn for CME) which reflects the success of the Bitmex contract in concentrating liquidity over the years, by starting earlier and by allowing investors to lever a lot more than CME for up to 100x. Average weighted leverage is admittedly lower than that, around 25x, but still ten times higher than the 2.5x allowed by CME. So accounting for the differences in leverage, the actual capital committed (which is a function of the open interest divided by leverage) by participants at CME futures is much bigger, perhaps four times bigger than the capital committed by participants at Bitmex (even as the open interest of the later is more than double).

In addition, the CME contract has been exhibiting strong momentum recently, making new records over the past quarter in terms of open interest, volumes, and investor participation: Q2 2019 was the strongest quarter to date with average daily volume of 10,710 contracts (53,550 equivalent bitcoin; $403MM), almost 200% greater than Q2 2018;

Greatest Open Interest – 6,069 contracts – June 26th(30,345 equivalent bitcoin; $385MM); Highest number of Large Open Interest Holders (a LOIH is any entity that holds at least 25 BTC contracts), 49 as of June 25th;

751 new unique accounts added in Q2, most added in any quarter; 34% growth from Q1 2019; and Over 1,070 accounts actively traded in June, the highest number observed in any month and 40% more than the active accounts in May.

Given the regulatory advantage of CME relative to Bitmex, we expect that strong CME momentum to continue. Courtesy: JPM

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary