Bitcoin has tumbled over 11% over the past five days, falling below $6,500 for the first time in recent months on Sunday. Still, U.S.-regulated bitcoin futures markets have seen their volumes explode over the last week.

Yes, Bakkt has been in the buzzing news ever since ICE which is the owner of the New York Stock Exchange, introduced Bitcoin futures trading platform for physical delivery facility. Thereby, if the traders wish to exercise the contract, they receive the actual Bitcoin upon expiration of the contract instead of cash settlement.

Such arrangement happens to be a huge benefit for the cryptocurrency market players, be it traders, investors or minors. However, initially, Bakkt’s launch has seen tepid response. In fact, the platform began with live trading as scheduled on 23rd September but with a lacklustre start of trading just over 70 bitcoins while the price tanked days later. Nonetheless, the volume has gradually been increasing since then.

Bakkt, in the recent past, has shown a record volumes of 2367 contracts traded today (i.e. around 17% compared to yesterday’s volume), which surpasses their previous record of 1756 contracts, and we are yet to close the day. Such a surge in trading volumes implies the maturing behaviour of cryptocurrency derivatives market. It would be prudent to observe that the above flashes most likely to increase further.

The current all-time high, according to Bakkt Volume Bot, is 2728 ($20.3 million) contracts and it took place a couple of days ago on November 23rd.

The underlying cryptocurrency markets have undergone a bearish rout over the last month, but quite a few firms are benefiting from the bearish price action. But for now, bitcoin price appears to be bouncing back.

Technically, CME BTC Futures price chart shows previous gap-up is now filled-in, gap-down pattern has now formed, and reckon good time to build fresh longs around $6-6.5k levels on oversold sentiments during the expiration. One can make out back-to-back hammer candles formation at 7330 and 7165 levels respectively.

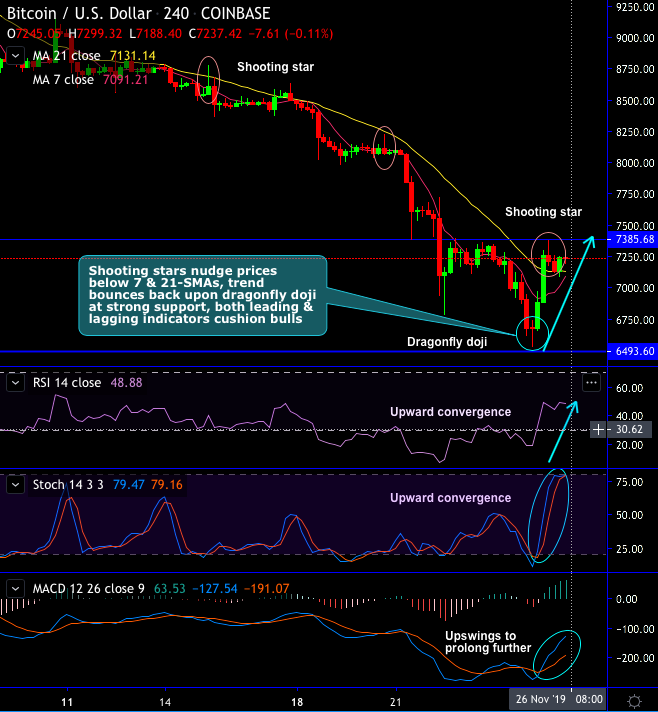

The intraday trading sentiments of the underlying price (BTCUSD at Coinbase) suggest intensified buying momentum. Shooting stars have nudged prices below 7 & 21-SMAs (refer 4H chart), the current trend bounces back upon dragonfly doji at 6675 levels, while both leading and lagging indicators cushion bulls.

RSI and Stochastic curves show upward convergence to the ongoing price rallies to indicate the strength and buying momentum in intraday trading rallies. To substantiate this bullish stance, bullish MACD crossover signals upswings to prolong further.

One can accumulate Bakkt’s monthly bitcoin futures contracts at the current levels (i.e. 7243 levels), if you expect further upside traction.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand