Bitcoin Option’s Implied Volatility And Open Interest Advantage:

The cryptocurrencies derivatives marketplace has been constantly evolving as new BTC options have seen increasing popularity among the institutional clients.

The predominant advantages that options offer is the facility to spout the collective insight of the underlying market and price discovery. Well, this could be achieved by measuring implied volatility (IV) and open interest that indicate the market's expectation and direction respectively of the underlying asset.

UK-based crypto research company, ‘Skew’ has demonstrated the options metric to analyse an attempt to end the debate over whether or not the upcoming 2020 Bitcoin halving is already priced in.

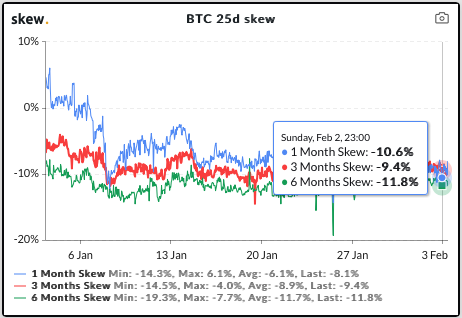

We infer that there is no dramatic kink in the implied volatility (refer 1st chart), hence, traders in the Bitcoin options market don't anticipate any major price moves at this juncture. However, the underlying market appears to be showing volatility just before moving with a big blow on either side, suggesting we could see a sudden surge and drop characteristic of the classic market adage "buy the rumor, sell the news."

Well, since the CME’s bitcoin options contracts launch on January 13th, the total volumes and open interests have risen to above $10mn according to data from skew.com, which is well above the peak thus far of the previously listed ICE/Bakkt options just over $1mn.

This still remains quite below the around $540mn of open interest on Derebit/LedgerX, which form the bulk of the total open interest in Bitcoin options (refer 2nd & 3rd charts), but the average daily volumes of the CME options since launch at around $1.1mn compares well with the average daily volumes on LedgerX over the same period of $0.4mn.

Moreover, while there is a gap between the open interest between offshore unregulated venues and the CME for futures, a substantial part of this difference is likely due to leverage. The minimum initial margin on offshore unregulated venues is typically around 1%, compared to the CME’s initial margin of 37%. For options, by contrast, there is less reason to expect such a divergence to persist, as margins are not used in the same way to gain leverage as for futures. Also, some hedge funds who do not necessarily have a fundamental view on bitcoin direction could see opportunities in trading volatility. The CME’s reputation and credibility in US derivatives markets more broadly could be a substantial advantage in attracting those potential market participants. Courtesy: JPM

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures