As more regulated financial derivatives products pegged to Bitcoin are launched, the better for the digital currency’s awareness level and adoption as an investment asset.

However, similarly to the launch of ICE’s Bakkt futures last month, the launch of CME’s Bitcoin options are unlikely to cause an aggressive price movement in one direction or the other.

But these fundamental developments are quite conducive for the crypto-universe, thereby, one can make out that the price of bitcoin will have attractive prospects sooner or later.

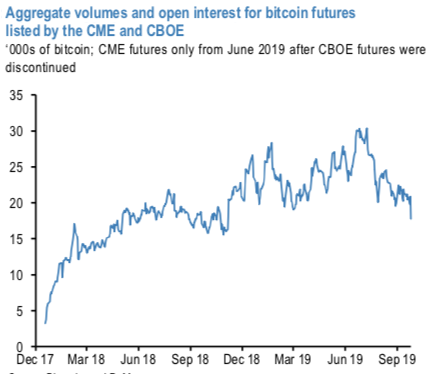

We note that the low initial volumes carry echoes of the initial listing of cash-settled bitcoin futures by the CME and CBOE back in December 2017, BTCUSD was struggling and oscillating between $400 - $700 levels during that course of time. Initial volumes were low (refer above chart), but the open interest kept growing steadily.

The listing of the CME futures coincided with all-time highs in bitcoin prices, and researchers at the San Francisco Fed suggested that by providing a market where bearish positions could be more readily expressed the listing of these futures contributed to the reversal of bitcoin price dynamics.

Similarly, options trading mechanism could have the potential to stimulate the prices and provide the impetus, so, what could drive the investors’ and traders’ interests in bitcoin options?

Let’s just quickly run you through the prime properties of CME’s most likely options trading mechanism for bitcoin:

Tracks to the regulated, robust CME CF Bitcoin Reference Rate (BRR), calculated daily on trade flow of major bitcoin exchanges and trading platforms.

Settles into actively traded CME Bitcoin futures (BTC).

Offers BTC traders potential to save on margins, through margin offsets.

Mitigates risk of counterparty default through central clearing.

Expands your choices for managing risk and building strategies.

For now, it is due to the regulatory approval, as more regulated financial products linked to Bitcoin are launched, the better for the digital currency’s awareness level and adoption as an investment asset.

Since the CME Bitcoin options will be options on futures as opposed to options on a physical asset, the introduction of regulated Bitcoin options on the CME should not have a massive impact on Bitcoin. The settlement will be in Bitcoin futures, which are cash-settled, so no actual Bitcoin will exchange owners in these transactions.

CME Bitcoin options will, however, enable Bitcoin companies to hedge their digital currency exposure in a more precise and affordable manner. That could help the growth of the Bitcoin startup ecosystem in the long-run.

Additionally, Bitcoin options traded on a reputable exchange such as the CME has the potential to introduce more Wall Street players in the digital asset markets, which could eventually lead to more buying of actual Bitcoin and other crypto assets in the future.

For those that have been following Bitcoin for several years, it is fascinating to see that traders will soon be able to trade futures and options on “magic internet money” on one of the largest derivatives exchanges in the world. Bitcoin’s ascent continues.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data