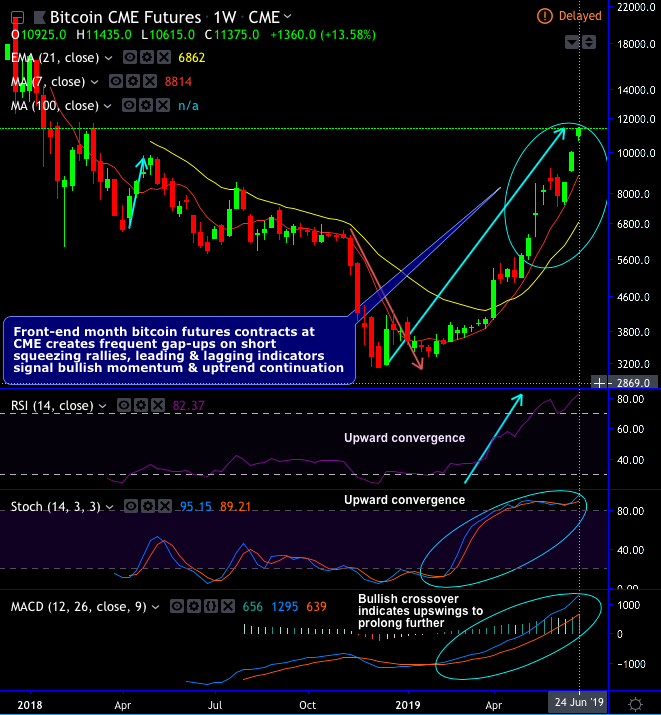

Of late, Bitcoin futures contracts at CME are screaming with the upside momentum vigorously due to the rapid spike in the underlying price of bitcoin that has shown upward moves more than a thrice from its recent lows of its bearish rout during 2018, and hit fresh 2019 highs and surpassed the psychological resistance of $10k mark.

For now, it is well on the verge of reclaiming its previous all-time high of $20,000 with intensified buying momentum as signaled by both the leading indicators (RSI and Fast stochastic curves).

However, having risen so sharply and swiftly, one can easily make out that the pioneer cryptocurrency has created considerable gaps quite often if you plot the technical charts of CME’s Bitcoin Futures contracts of near month deliveries. It is nothing new but owing to the short squeezing activities.

Because it is quite natural in any derivatives market and nothing to be panicked, a short squeezing scenario occurs during a circumstance in which the underlying security reverses the trend and moves considerably higher to give severely shorted-side a trade paralysis. Thereby, the short sellers, with an intention of not bucking the trend, would be squaring-off their existing positions to minimize losses (may not be in all cases) and wish to mitigate the upside risks on the security. Same is the case with bitcoin futures.

Well, the year-2019 has been conducive for a prevailing bull run of bitcoin that displays these gaps on CME futures contracts.

Whether the process of short squeezing could be momentary or last longer absolutely depends on the underlying price trend which is in turn dependant on the fundamental factors revolving around the entire cryptocurrency industry’s ability to generate a more positive outlook for its investors or resume its bearish streaks. Hence, unwise to jump the guns, all we have to bother is that follow the trend because the trend is our friend.

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards 149 levels (which is highly bullish), and hourly USD spot index has bearish index is struggling at -141 (highly bearish) while articulating (at 11:09 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025