RBC Capital Markets notes:

1 - 3 Month Outlook - USD/CAD toward the highs

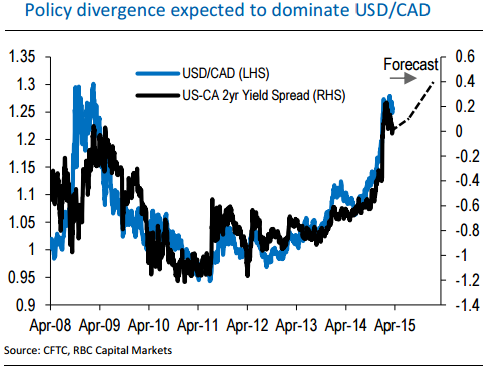

After rebounding from its low in May, USD/CAD has rebounded through June, and in the coming months, we continue to look for the pair to extend to new highs. We believe the key drivers of USD/CAD strength should come to a head in the second half of 2015 and we continue to call for a Q3 peak of 1.31.

The main drivers include: 1) Monetary policy divergence. The BoC has taken on a firmly neutral message, and our economists expect the BoC to keep rates at 0.75% until Q2 2016. Regardless of the exact timing of an eventual rate increase though, the issue is that the BoC hiking cycle will considerably lag that of the Fed, which is likely to begin in the second half of this year.

2) Greater downside risk to Canadian activity. Q1 growth was even worse than anticipated, and what matters now is whether we begin to see the rebound in Q2 that the BoC has said they expect. Early signs suggests there is a strong risk that Q2 disappoints the BoC's projection of 1.8%q/q growth. That should weigh on rate expectations and CAD.

3) Oil has bounced, but we do not anticipate any significant shift in the larger macro outlook unless prices rise above the breakeven threshold for new oil sands projects (WTI above the mid-USD70s/bbl). Our commodity analysts do not expect a strong rebound in oil prices (forecasting USD53/bbl average WTI in 2015).

6 - 12 Month Outlook - USD/CAD sustainably higher

As we enter 2016, we look for a gradual pullback in USD/CAD from a peak later this year. By then, we expect the trends that have driven the pair higher should unwind somewhat. Oil prices are anticipated to recover more significantly (RBC forecasting WTI USD77/bbl in 2016); the benefits of a weaker currency should show more clearly in exports and non-energy capital investment; and US/CA monetary policy should begin to converge. Other than against USD, we expect CAD to have mixed performance among the G10.

One issue that has kept us generally bearish on CAD over the medium term has been the type of funding of the current account deficit. The issue bears watching in the coming months because long-term capital inflows have jumped in H1 this year-mostly on a surge in bond flows-however, we suspect that may be temporary. For now, that leaves us still medium term bearish still.

Currency Outlook: Canadian Dollar

Monday, July 6, 2015 11:31 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed