RBC Capital Markets notes:

1 - 3 Month Outlook - EUR/CHF capped by politics

On the Monday after the Greek referendum was announced, the SNB's Chairman Jordan confirmed that the SNB intervened in the FX market in a difficult situation. He said the Eurozone is more robust than it was a few years ago and that he doesn't think Greece will destabilize others in the union though went on to say if a country left the Euro, one would have to ask questions about the union.

On the Monday after Greece voted No in the same referendum, EUR/CHF was much better behaved, it did not even make it as far as 1.0350, before bouncing back to 1.0440 where it has traded for most of the past month. At its latest meeting in June, the SNB repeated that it would remain active in FX to keep the "significantly overvalued" CHF down so it was not entirely surprising that the SNB felt it needed to intervene on June 29.

Nevertheless traders report that the intervention was limited which is backed up by analysts looking for the June reserves data (due this week) to remain stable around CHF516bn. It was just enough to prevent EUR/CHF from a rapid test of parity (low 1.0310) and as the day wore on and markets digested news of the Greek referendum, the tightening in EGB spreads coupled with the recovery in other markets, allowed EUR/CHF to grind back up. The threat of SNB intervention may be enough to avoid a test of parity as long as a Greek EUR exit is avoided. But the ongoing uncertainty surrounding Greece, particularly over the next month, will act as a cap on any EUR/CHF rallies.

The technical outlook for USD/CHF is bullish near-term with our analysts highlighting the confluence of resistance between 0.9529 (200dma) and 0.9545 (May 15 high). Rallies over the coming quarter should struggle at 0.9866. On the downside, initial support is the 50dma at 0.9333.

6 - 12 Month Outlook - Closer to fair value

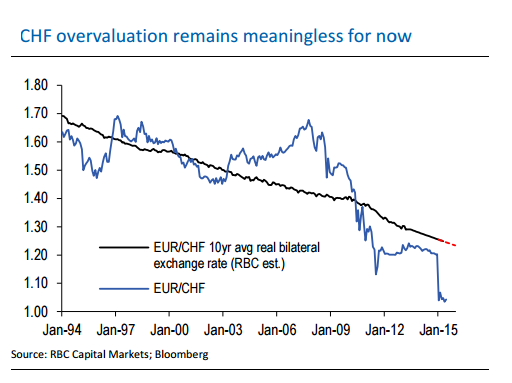

As we have noted before, fair value for EUR/CHF (and even more so USD/CHF) has declined over time, given the negative inflation differential between Switzerland and the rest of the world. But it is not declining fast enough to meet EUR/CHF at current spot (our lowest fair value estimate still puts EUR/CHF at 1.13). As safe haven flows and EZ political risks diminish, we expect to see EUR/CHF eventually trade up to 1.15

Currency Outlook: Swiss Franc

Tuesday, July 7, 2015 12:59 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed