Dollar index trading at 94.91 (+0.04%)

Strength meter (today so far) - Aussie -0.63%, Kiwi -0.14%, Loonie +0.33%.

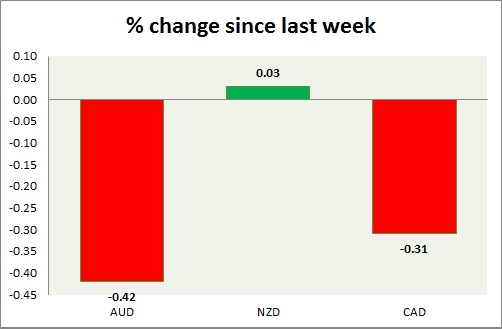

Strength meter (since last week) - Aussie -0.42%, Kiwi +0.03%, Loonie -0.31%.

AUD/USD -

Trading at 0.729

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range

Support -

- Long term - 0.60, Medium term - 0.65, Short term - 0.685, immediate - 0.695

Resistance -

- Long term - 0.83, Medium term - 0.785, Short term - 0.745

Economic release today -

- Westpac consumer confidence to be released at 23:30 GMT.

Commentary -

- Aussie reverses its longest winning streak since 2009 as Chinese imports dropped -17.7% y/y in September. Active call - Sell Aussie @ 0.76 with stop around 0.785 and 0.825 to target 0.715, 0.70, 0.685 and 0.65.

NZD/USD -

Trading at 0.669

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range

Support -

- Long term - 0.56, Medium term - 0.60, Short term - 0.615

Resistance -

- Long term - 0.71, Medium term - 0.68, Short term - 0.68

Economic release today -

- RBNZ governor scheduled to speak at 21:30 GMT.

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. Kiwi is the best performer this week so far.

USD/CAD -

Trading at 1.297

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.19, Medium term - 1.26, Short term - 1.29,

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.35

Economic release today -

- NIL

Commentary -

- Loonie is the best performer today, gaining sharply as oil recovered from slump.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings